Green Home Certification Benefits

Canadian homeowners can reap significant financial rewards by obtaining green home certifications like LEED (Leadership in Energy and Environmental Design). These certifications not only contribute to environmental sustainability but can also lead to substantial property tax reductions and other monetary incentives.

Understanding LEED Certification

LEED certification is a globally recognized symbol of sustainability achievement and leadership. For homes, it focuses on:

- Energy efficiency

- Water conservation

- Sustainable materials

- Indoor environmental quality

- Location and transportation

Financial Benefits of Green Home Certification

1. Property Tax Reductions

Many municipalities in Canada offer property tax reductions for homes with green certifications. For example:

- Toronto offers up to a 5% property tax reduction for LEED-certified homes

- Vancouver provides a 5-10% reduction based on the level of LEED certification

2. Energy Credits

Certified green homes often qualify for energy credits from provincial utilities. These can include:

- Rebates on energy-efficient appliances

- Credits for solar panel installations

- Reduced rates for electricity consumption

3. Increased Property Value

While not a direct tax benefit, LEED-certified homes typically have higher resale values, which can lead to long-term financial gains.

How to Obtain Green Home Certification

- Assess your home's current energy performance

- Implement necessary upgrades (e.g., improved insulation, energy-efficient windows)

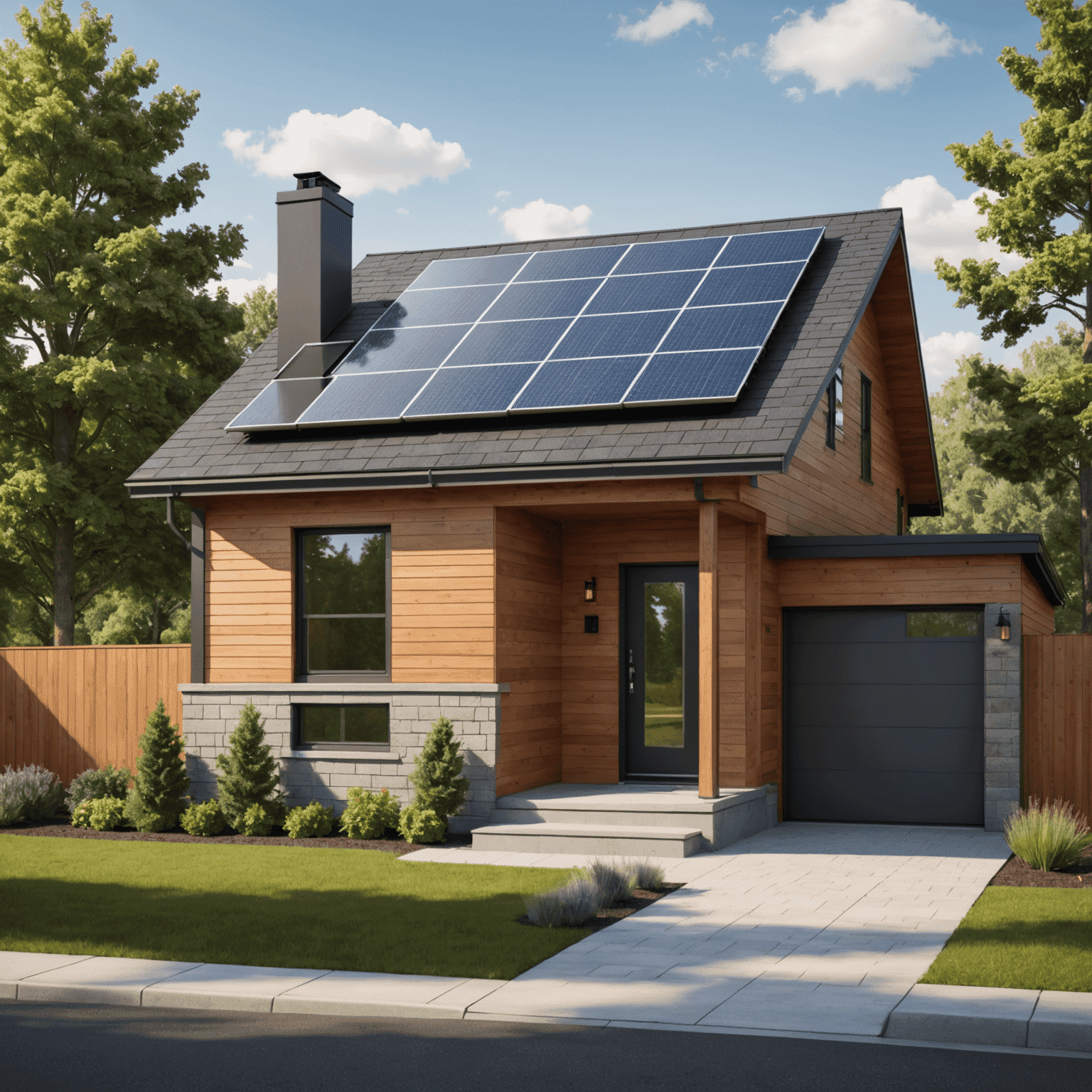

- Install renewable energy systems if possible (e.g., solar panels)

- Apply for certification through organizations like the Canada Green Building Council

- Undergo the certification process, including inspections and documentation

Additional Tax Incentives for Green Homes

Beyond certification-specific benefits, Canadian homeowners can also take advantage of various tax incentives for green energy improvements:

- Federal tax credits for energy-efficient renovations

- Provincial rebates for upgrading to high-efficiency heating and cooling systems

- Municipal grants for green roof installations

Key Takeaway

Investing in green home certification not only contributes to environmental sustainability but also offers tangible financial benefits through tax incentives and energy credits. Canadian homeowners should explore these opportunities to reduce their environmental impact while enjoying significant cost savings.