Energy-Efficient Home Improvements: Tax Deductions and Savings

Investing in energy-efficient home improvements not only reduces your carbon footprint but can also lead to significant tax deductions and lower energy bills. Let's explore some key upgrades that can benefit both your wallet and the environment.

Insulation: The Foundation of Energy Efficiency

Proper insulation is crucial for maintaining your home's temperature and reducing energy consumption. The Canadian government offers tax incentives for homeowners who improve their insulation:

- Attic insulation upgrades can qualify for up to $1,500 in tax credits

- Wall insulation improvements may be eligible for up to $2,000 in deductions

- Floor insulation enhancements can result in up to $1,000 in tax benefits

Energy-Efficient Windows: A Clear View to Savings

Replacing old windows with energy-efficient models can dramatically reduce heat loss and gain. Here's what you need to know:

- ENERGY STAR certified windows can qualify for up to $500 in tax credits per window

- Triple-pane windows offer superior insulation and may be eligible for higher deductions

- Low-E coatings and argon gas fills further enhance energy efficiency

HVAC Systems: Breathing Easy with Tax Benefits

Upgrading your heating, ventilation, and air conditioning (HVAC) system can lead to substantial energy savings and tax deductions:

- High-efficiency furnaces (95% AFUE or higher) may qualify for up to $3,000 in tax credits

- Energy-efficient air conditioners (SEER 16 or higher) can be eligible for up to $2,000 in deductions

- Smart thermostats, when part of a comprehensive HVAC upgrade, may add to your tax benefits

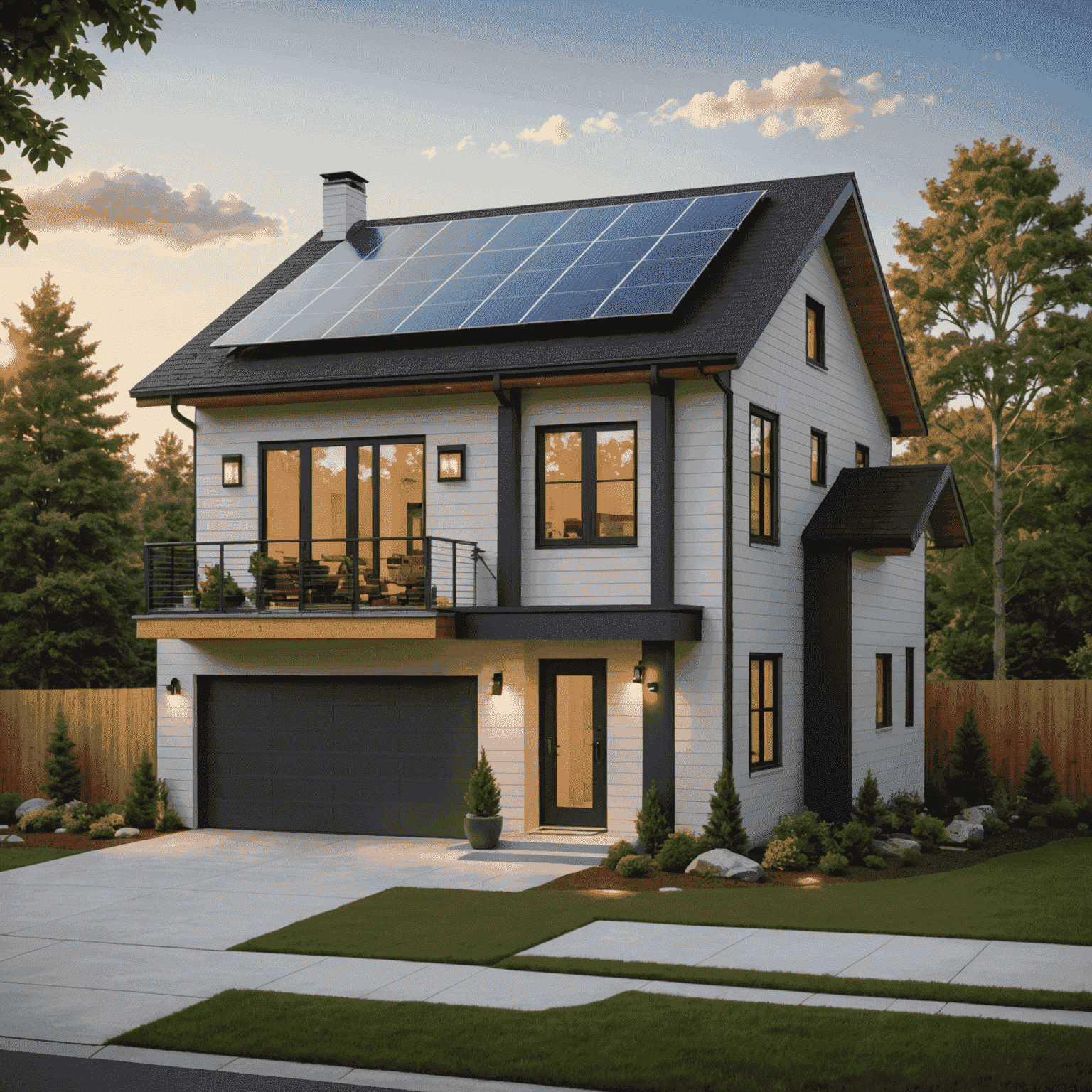

Solar Panel Installation: Harnessing the Sun for Savings

Solar energy is a powerful way to reduce your reliance on the grid and benefit from generous tax incentives:

- The Canadian Greener Homes Grant offers up to $5,000 for solar panel installations

- Additional provincial rebates may be available, varying by location

- Solar installations can significantly reduce or eliminate your electricity bills

Conclusion: Invest in Your Home and the Environment

By making energy-efficient improvements to your home, you're not just reducing your carbon footprint; you're also taking advantage of valuable tax incentives and energy credits. These upgrades can lead to long-term savings on your energy bills while increasing the value of your property. Remember to consult with a tax professional and certified energy auditor to maximize your benefits and ensure compliance with current regulations.